The Piercing Pattern – Multiple Candlestick Pattern

What Is The ‘Piercing’ Candlestick Pattern?

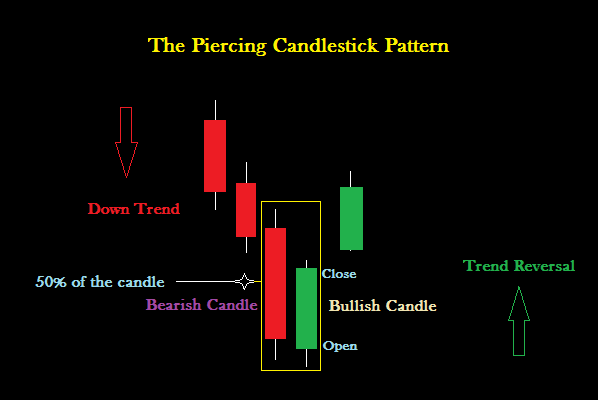

The pattern got this name because the prices pierce up through the falling market. Piercing candlestick pattern is a bullish trend reversal pattern. The piercing pattern is very similar to the bullish engulfing candlestick pattern with a minor variation.

Formation Of The Piercing Pattern

It is formed by the combination of two candlesticks. The first candle is a falling black candle and the second is the reversal white candlestick.

In a bullish engulfing pattern, the green/bullish candle engulfs the red/bearish candle completely. However, in a piercing pattern, the green/bullish candle partially engulfs the red/bearish candle. The engulfing should be between 50% and less than 100%. Example, if the red candle’s range (Open – Close) is 10, the green candle’s range should be at least 5 or higher but below 10.

Psychology Behind The Piercing Pattern

During a down trend, the market keeps falling making new lows. On the first day (or specified time period) of the piercing pattern formation, the market as expected moves lower, forming a red candle. Next day, the price opens below the previous day’s closing price and attempts to make a new low. At this low point of the day, there is a sudden buying interest from the bulls, which drives the prices up. But the bears are still happy to sell on the rise.

However, the bulls keep buying and also force those who short at the high price to cover their position to limit the loss. At the end of the day, the price closes above its opening price thereby covering minimum 50% length (or more and less than 100%) of the previous day’s red candle. This indicates that the bulls are taking control of the market. One should look to buy after such movement as the bullishness is expected to continue over the next few successive trading sessions.

Significance Of The Piercing Pattern

As shown in the above image, the piercing candlestick pattern is effective in a falling market and signals a bullish trend reversal on the charts.

Significance of the piercing pattern increases if second day’s opening price is below a support area and close is above the support area. If the second candle is a bullish marubozu or with no upper or lower shadow, it implies more bullishness in the market. Its importance is even more if it is accompanied by increased volume.

* The counterpart of the Piercing pattern is the Dark Cloud Cover candlestick pattern.